Ajmal Ahmadi’s presence as the acting governer of the Central Bank has long been controversial and his actions are questionable. Now, a review of 8 Subh shows that Ahmadi is Heshmat Ghani Ahmadzai’s son-in-law and a close associate of President Ghani. Ajmal Ahmadi’s inappropriate treatment of a number of employees was not without reason. Credible government sources say the acting governer of Central Bank suffers from Paranoid Personality Disorder and is currently receiving treatment. This disorder that makes a person suspicious, distrustful and aggressive towards those around him.

After taking over the Central Bank as its acting governer, he dismissed the deputies, managers and employees, and issued more than 100 warnings to the employees of the bank. Employees who had spent millions of dollars over the past two decades to standardize their financial and banking sectors.

The Central Bank, led by Ahmadi, has not had an executive board for a year now, and the bank’s Supreme Council has not been completed. The emptiness of the board of directors is so palpable that during his absence, he appointed one of the bank’s employees, who was unfamiliar with English and was not an employee of the bank’s core division, as the bank’s auditor. In addition, the most important directorates of the bank, including the General Directorate of Monetary Policy, Accounting and Finance, Legal Affairs and Financial Intelligence are managed by ‘care-takers’.

Ahmadi has transferred or hired most of his team members from the Presidential Finance and Banking Advisory Board and the Ministry of Industry and Trade, regardless of specialty or field of study; as action that is illegal. Also, some of his allies, who are not bank employees, use the vehicles carrying Central Bank employees for personal purposes in a situation where the bank has experienced more deadly explosions on its employees.

According to members of parliament and financial and banking experts, making parallel advisory positions for Ajmal Ahmadi in the past and the president’s support for his illegal actions now calls into question the bank’s independence and consider it a political institution that follows the presidency, which is against the law.

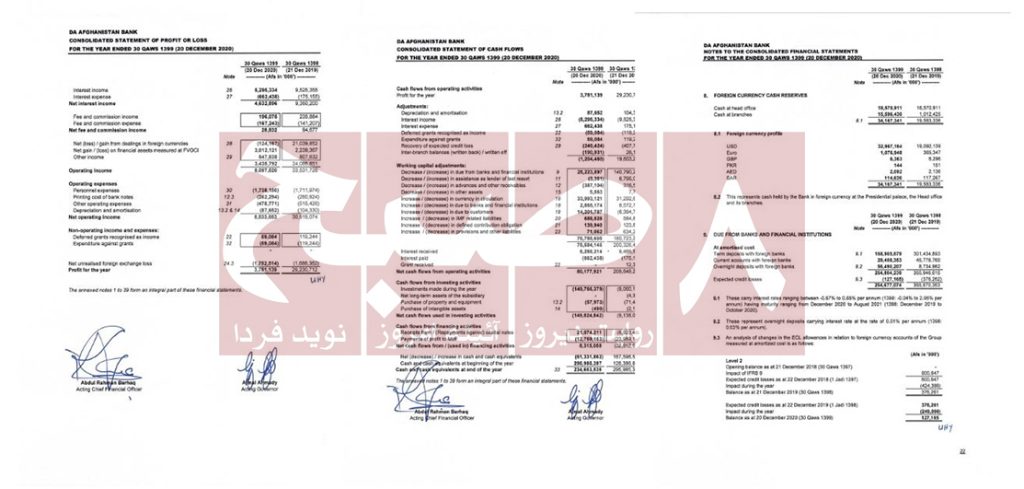

Now, a year later, his leadership at the Central Bank for the heavy financial sector is over. The reduction of 24 billion Afghanis in bank revenues is one of the most important aftershocks of Ajmal Ahmadi’s management in the Central Bank. While the bank had earned about 21 billion Afghanis from the understanding of the currency in fiscal year 2019, during its time it has fallen by 101 percent and has lost 124 million Afghanis. In addition, the bank’s monetary income in his time has fallen by more than four billion Afghanis due to what is called “conservativeness” by experts.

Unnecessary auction of money from his working group has exacerbated concerns because in about a month (from June 5 to July 11 2021), the Central Bank has spent more than $700 million to keep the Afghan price stable. However, according to the Central Bank, recent fluctuations in exchange rates have no economic factor or monetary policy. Experts believe that if such a policy continues, the bank, in addition to not finding a long-term solution, will in the near future face the serious challenge of devaluation of foreign exchange reserves and further devaluation of the Afghani.

Ahmadi has also increased the foreign exchange reserves of the Central Bank’s offices by 15 times as the provinces are on the verge of collapse and national capital is being looted. This is a suspicious move for members of parliament and a surprise for those familiar with finance and banking. However, the amount of money of bank branches should normally be much less. Of course, according to the global standard of operational risks, even one Afghani of treasury money must be transferred from the branches to the Central Bank in an emergency.

On the other hand, some of the Central Bank’s actions during his tenure have been limited to media hype and attempts to quell popular protests, including the dismissal of a female Central Bank employee and her team member for failing to include the Pashto language in the meeting’s commitment document in the Geneva Convention, which is not true. These include the claim of making 70 new regulations, which in the end were just a compilation of the previous Central Bank regulations under the title “Book of Regulations”. It is worth mentioning that the officials in the Central Bank, despite repeated insistence and requests based on the law, refused to answer to 8 Subh questions in accordance with the law on the right of access to information. The Access to Information Commission, meanwhile, calls the Central Bank the most private government agency for obtaining information.

Who is Ajmal Ahmadi?

Ajmal Ahmadi is the husband of Hana Sofia Ghani and the son-in-law of Heshmat Ghani Ahmadzai. At least five credible sources, particularly government sources, confirmed this. 8 Subh also has the necessary evidence to prove Ajmal Ahmadi’s connection to Hana Sufi Ghani and Heshmat Ghani. Meanwhile, a letter was recently sent from the Central Bank to the Presidential Palace, in which Ahmadi asked for a two-week leave to spend his wedding in Dubai, the capital of the United Arab Emirates.

Thus, Ajmal Ahmadi is the son-in-law of Mohammad Ashraf Ghani’s brother and a close associate of the president. According to the Central Bank’s website, he holds two master’s degrees, the first in administration and business from Harvard University in the United States and the second in economics and public administration from Harvard Kennedy University in the United States.

Paranoid Personality Disorder (PPD)

Authoritative government sources confirm to 8 Subh that the acting governer of the Central Bank suffers from a personality disorder called “Paranoid Personality Disorder” and is currently under treatment. According to psychologists, this disease is part of 10 personality disorders and has serious symptoms that are clearly seen in a person’s performance. They state that people with the disease do not trust others and try to control everything by force. These patients are also irritable and get angry very quickly.

In addition, people with this disease are fanatical and negative, and because of the sense of danger from those around them, they quickly resort to humiliating those around them. However, according to psychologists, patients with this disease demand more prestige and respect, and any random action to them is considered disrespectful. Some psychologists say that addiction to certain types of drugs is one of the causes of this disease. These psychologists find it very difficult to treat paranoid personality disorders because the patient doubts even the doctor.

Start of a Government Mission in a Parallel Advisory Role

Ajmal Ahmadi’s entered the government on April 14, 2015, when Mohammad Ashraf Ghani appointed him senior financial and banking advisor under Decree Number 150. According to the law of Da Afghanistan Bank, the Central Bank is the government’s advisor and banker. The fifth paragraph of Article 2 of this law states that the Central Bank is responsible for performing the duties of “banker, advisor and financial representative of the government.” However, Ashraf Ghani appointed his brother’s son-in-law as his advisor instead of going to the Central Bank in accordance with his plans and against the explicit provisions of the law.

The Presidential Palace even called for Ahmadi to attend the bank’s Supreme Council, but this was opposed by the bank’s leadership and some international institutions because it was called an attempt to violate the principle of bank independence. However, sources point out that Ahmadi always criticized the leadership of the Central Bank and their performance in various meetings. According to sources, due to his presence in some meetings, in some cases, he has even presented the Central Bank’s proposals to foreign institutions under the name of his self-made program to the president.

Ahmadi was retained as a ‘caretaker’ and candidate for Minister of Industry and Trade on February 6, 2019 based on two separate presidential decrees. His presence in the Ministry of Industry and Trade was the beginning of the media coverage of his controversy. Documents were later released indicating that he had illegally fired high-ranking employees of the ministry and replaced them with caretakers. Even in January 12, 2021, the House of Representatives suspended the budget of the Ministry of Industry and Trade and said that it did not recognize Ahmadi’s leadership. It further called on government agencies not to accede to Ajmal Ahmadi’s signature.

Expanding the Scope of Governance to the Central Bank

Khalil Siddiq, the former head of the Central Bank, resigned on June 16, 2019, and Wahedullah Noshir, the bank’s first deputy governor, was appointed to acting governer the bank. Before the end of the fiscal year 2019, Mohammad Ashraf Ghani ordered 15 billion Afghanis of the Central Bank’s profits be transferred to the revenue account of the Ministry of Finance before the end of the fiscal year. The move met with a backlash from former bank officials because the second paragraph of Article 29 of the Law of Afghanistan Bank stipulates that the remainder of net operating income is transferred to the government within four months after the end of the fiscal year and the remainder of unrealized valuation benefits (if any) to the valuation reserve account is allocated in “the balance sheet of Afghanistan Bank.”

On the other hand, the government cannot pressure the Central Bank to achieve its goals, and this is explicitly stated in the third paragraph of Article 3 of the Bank of Afghanistan Law. Paragraph 4 of this article also states that the members of the Supreme Council, the Board of Directors and other employees of the Bank are obliged to increase the dignity and reputation of Da Afghanistan Bank as the Central Bank and holder of “complete independence that impartially serves all people” and “avoid action to the contrary.”

Thus, the bank officials asked the president to send such a request to the bank based on the official decree. Ghani eventually instructed Sarwar Danesh, the second vice president, and Sayed Yosuf Halim, the head of the Supreme Court, to consider a legal solution to receive the money. The dispute between the Presidential Palace and the bank officials has been going on since then. Finally, June 3, 2020, Mohammad Ashraf Ghani appointed Ajmal Ahmadi, his brother’s son-in-law, as the acting governer of Da Afghanistan Bank, in Decree No. 544. However, his position as an advisor was reserved for some time.

Is Ajmal Ahmadi’s Presence in the Central Bank Legal?

The presence of Ajmal Ahmadi as a person close to the president’s family is problematic from both political and legal perspectives. The third paragraph of Article 3 of the Da Afghanistan Bank Law states: “In order to achieve its goals in accordance with the provisions of this law, Da Afghanistan Bank has full independence and no person can unduly influence the members of the decision-making board of Afghanistan Bank in the performance of their duties or otherwise interfere in the activities of Afghanistan Bank.”

According to reports, former bank officials did not meet with the president except as specified in the law. Now, however, the bank’s leadership occasionally has close meetings with the president and visits to the presidential palace. Authoritative sources at the presidential palace told 8 Subh that Ajmal Ahmadi had a close relationship with the president and could meet with him at any time without going through the administrative process.

On the other hand, Ajmal Ahmadi’s advisory position was canceled as soon as he joined the bank, and some of its employees were hired at the Central Bank. According to the law of Da Afghanistan Bank, there was no need for a financial and banking consultation in the Presidency and if there were a need, it should not have been removed from the list of consultations now. The presidential palace’s move fueled speculation about paving the way for Ahmadi’s presence at the bank and government intervention in the country’s financial and banking sector.

According to financial and banking experts, the Central Bank’s authority also requires that an independent, non-government person hold the bank’s seat. According to the sixth paragraph of Article 2 of the Law on Da Afghanistan Bank, this bank, among other duties, is responsible for “issuing or registering licenses, regulating and supervising banks, money changers, monetary service providers, payment system operators, securities service providers, document transfer system operators and other persons who can be supervised by Da Afghanistan Bank in accordance with the provisions of the law.”

Meanwhile, the Central Bank is also authorized to review individuals’ bank accounts. The second paragraph of Article 3 of the Law on Afghanistan Bank states: “Persons who have obtained an activity license in accordance with the provisions of this law and are registered by Da Afghanistan Bank, and can obtain the information that they deem necessary in the implementation of their supervisory duties from the above-mentioned persons.”

Experts say that if the bank’s leadership has political connections in violation of the provisions of Da Afghanistan Bank’s law, they can use their authority to monitor all citizens’ bank accounts and obtain information. In this way, the presence of a person close to the president at the leadership level of the bank causes, on the one hand, the use of national treasuries for government officials for various reasons, and on the other hand, the presidential palace can access financial accounts by the leadership and use the bank as leverage over other politicians. Financial and banking experts also believe that the presence of a person close to the president’s family has practically and severely questioned the independence of the Central Bank.

For their part, members of the House of Representatives believe that the Central Bank currently has no independence. Hojjatullah Kheradmand, the deputy secretary of the House of Representatives, told 8 Subh that the president had illegally kept Ajmal Ahmadi in his seat despite his dismissal by the parliament. Kheradmand considers this as part of the efforts to violate the principle of independence of this institution and believes that Ashraf Ghani during his rule did not leave any institution to act independently. He cited parliament as an example, saying that President Ghani is coercing and trying to bring the legislature under his control.

However, according to the law regulating the supervision of ministries and government departments, which was implemented during President Ghani, Ajmal Ahmadi’s presence in the bank’s seat is illegal. Article 5 of the law, entitled ‘Instances of Non-appointment of a Caretaker’, states: “If the candidate for the Ministry or Administration does not receive a vote of confidence from the House of Representatives or the Minister is deprived of the vote of confidence by the House of Representatives during the performance of his/her duties, he/she cannot be appointed as a caretaker in the same ministry or department.”

Waheed Farzayee, a legal expert, told 8 Subh that although the president’s decree was unconstitutional, even under the decree, no one could serve as caretaker after receiving a no-confidence vote in parliament. He added that Ajmal Ahmadi is not legally the acting governer of the Central Bank, so that bank employees can reject any of his instructions under the law.

Banking Experts: The Politicization of the Banking Sector is Not Acceptable

Financial and banking experts also question the presence of Ajmal Ahmadi as the acting governer of the Central Bank. Seyar Quraushi, a finance and banking expert with the background of Ghazanfar Bank and the chair of the Afghan Bankers’ Union, told 8 Subh that according to Article 12 of the constitution, Da Afghanistan Bank should be an independent institution and the Central Bank of the government and the basis of its independence should be preserved. He stated that the politicization of an independent non-political, technical and financial institution of the financial sector is not acceptable, and this will greatly affect the future of the country and the financial sector.

The financial and banking expert added that according to the fourth paragraph of Article 3 of the Afghanistan Bank Law, members of the Supreme Council, the Board of Directors and other employees of the bank are obliged to maintain the dignity and reputation of the bank as a fully independent Central Bank. According to Quraishi, with Ahmadi in the Central Bank, some laws have been violated and acted upon for personal interest. He criticized illegal employment, illegal and discriminatory dismissals, employment of family members, group employment and the transfer of a working group from financial and banking consulting to the Ministry of Industry and Trade and then to the Central Bank.

In addition, Quraishi said, the acting governer of the bank and its Supreme Council need to clarify the creation of unnecessary and parallel directorates, including the bank liquidation directorate and the international relations directorate because, in his opinion, even after the bankruptcy of some banks, there was no directorate called the liquidation of banks.

Seyar Quraushi added that during Ajmal Ahmadi’s work, additional deputies were created in the branches, without any real analysis or need. In addition, he said, despite the reduction in workload, there has been overcrowding in the Central Bank governor’s office. He cited transfers and the use of “appointments in contrary to expertise and field of study” as other shortcomings, and called the issuance of warnings and recommendations, especially the issuance of more than 100 recommendations and warnings to bank employees, unjustified and illegal. At the same time, he criticized the non-observance of the provisions of the country’s applicable laws for the continuation of supervision, and said that Ajmal Ahmadi and the Supreme Council of the Bank should clarify the non-observance of the provisions of the law in dismissing deputies and governors of the Central Bank.

Filtration of Employees and Coercion with Ghani’s Support

By heading the Central Bank, Ajmal Ahmadi ousted high-ranking officials of the Central Bank one after another. After closing the office of one of the bank’s deputies, he called him directly to his house and warned him that he had been fired by the decision of the bank’s high council. After the deputy stressed that the action was illegal, Ajmal Ahmadi implicitly “threatened” him and mentioned having the support of President Ghani in this regard. Although the Central Bank official continued to request a letter of resignation from the Supreme Council, no documents were provided to him until 10 days after the decision.

Following this, the process of transfer, dismissal, forced resignation and retirement of other former employees of the bank became key controversies. These changes were met with a wave of reactions. Finally, on July 25, 2020, by Presidential Decree No. 1019, financial and banking advisory was canceled. On December 2, 2020, Ajmal Ahmadi did not receive a vote of confidence from the parliament, but he remained in charge and continued his work. In addition to his illegal presence, the dismissal of staff led some of the key directorates, including monetary and fiscal policy and accounting and financial intelligence, to be run by caretakers for a year.

Ahmadi’s continued work was met with a backlash from the House of Representatives, who in a letter to the Ministry of Government in Parliamentary Affairs declared the signature of Ajmal Ahmadi, acting governer of the Central Bank, invalid. However, the Presidential

Palace has not yet decided to send another person to the Central Bank to replace Ajmal Ahmadi.

Disregarding Capacity Building Worth Billions; The Experienced Were Dismissed

Simultaneously with the presence of Ajmal Ahmadi in the Central Bank, this institution underwent extensive changes. In the process, he has fired experienced Central Bankers for various reasons and hired new ones illegally. Dozens of senior bank employees have reportedly been forced to resign, retire, or wait for their salaries after Ajmal Ahmadi joined the Central Bank. According to sources, all of these individuals have been recruited through free competition at the Central Bank in recent years, and millions of dollars have been spent by the Central Bank, the International Monetary Fund and several other institutions to increase their capacity.

This is not all. The dismissed people say that the employees were not allowed to enter the Central Bank after being fired or transferred to other agencies. Thus, the security department of the bank, according to the order of the leadership of the Central Bank, has opposed the presence of previous employees. Meanwhile, one of the bank’s deputies, while going to his office to submit his resignation, was stopped by the bank’s security. In addition, the office of another deputy of the bank was surrounded by the security on the day of his dismissal.

More importantly, the bank, in coordination with other government agencies, has prevented the hiring of employees and resigned from other institutions. According to sources, Ajmal Ahmadi amended a regulation to suggest to the Supreme Council that resigned or dismissed individuals could not be employed by the Central Bank for up to 10 years unless the Supreme Council approved it. It also does not, in coordination with other departments, allow former employees of the bank to compete for seats in other institutions. However, this regulation is contrary to the provisions of the law.

It should be noted that this action of the Supreme Council of the Central Bank is also called interference in the administrative affairs of the bank, because the main work of this council is policy-making, budgeting and the formation of the bank. In addition, credible sources from the Central Bank confirmed to 8 Subh that Ajmal Ahmadi had created unnecessary directorates and deputies to hire and relocate people close to him, and had deliberately removed the positions of the bank’s senior and experienced employees.

These actions take place while a number of bank employees have received loans during their tenure, and now that they have to pay off their debts in addition to being fired, they are having difficulty trying to do so. It should be noted that some current employees of the bank are also complaining about the current situation and about the abusive treatment by Ajmal Ahmadi.

| Senior Employees That Were Removed | ||||

| No. | Name | Position | Work Experience in Central Bank | Education Level |

| 1 | Mohammad Qasim Rahimi | Second Deputy | 15 years | Master’s in Banking and Finance |

| 2 | Sayed Yonus Sadat | Director of Finance | 12 years | ACCA Diploma |

| 3 | Abaseen Mal | Director of Procurement | 12 years | Bachelor of Economy |

| 4 | Mohammad Saleem Salah | Director of Financial Intelligence | 13 years | Master’s in Management and Trade |

| 5 | Samiullah Mahal | Director of Projects | 12 years | Master’s in Management and Trade |

| 6 | Mohammad Kakar | Head of Afghanistan Payment System | 5 years in Central Bank and 12 years in Banking Sector | Bachelor of Software Engineering from Tehran, Iran |

| 7 | Emal Hashoor | Director of Central Office | 13 years | Master’s in Management and Trade |

| Forced Resignation or Retirement | ||||

| No. | Name | Position | Work Experience in Central Bank | Education Level |

| 1 | Mir Shikeb | Director of Financial Service Development | 12 years | Master’s in Economic policy from the US |

| 2 | Sayed Ghafoor Sadat | Director of Supervision of non-Banking Institution | 9 years | Master’s from USA, UK and Malaysia |

| 3 | Sayed Muhsin Sadat | Deputy of Supervision of non-Banking Institution | 8 years | Master’s in Management and Trade |

| 4 | Abdul Rahamn Sheerzad | Manager of Supervision of non-Banking Institution | 5 years | – |

| 5 | Sharifullah Shagiwal | Spokesperson | 1 year | Bachelor of Journalism |

| 6 | Anwar Shah Yosufi | Western Zone Director | 38 years | Master of Economy |

| 7 | Ahmad Khalid Meraj | Deputy of Financial Policy | 5 years | Master of Economy from the UK |

| 8 | Nayeb Khan Jamal | Director of Financial Policy | 9 years | Master of Economy |

| 9 | Zarmina Samadi | Deputy of Human Resources Traianing | 25 years | Bachelor of Economy |

| 10 | Aziz Momand | Director of Banking Institution | 12 years | Two master’s in Economy and Public Policy from Germany and Austria |

| Transfer to a Position in Contrary to Field of Study, Disciplinary Transfer, Demotion, Dissolution of the Position | ||||

| No. | Name | Position | Transferred to | Status of Transfer |

| 1 | Hilal Ahmad | Manager of International Relations | General Directorate of Financial Services Development | Contrary to Field of Study and in violation of the Regulation on Intrinsic Affairs of Civil Service Employees |

| 2 | Abdul Habib Ahmadzai | Director of Western Zone | Director of Herat Zone | In violation of the Regulation on Intrinsic Affairs of Civil Service Employees |

| 3 | Hameedullah Sahak | Legal consultant | Director of Public Registration | In violation of the Regulation on Intrinsic Affairs of Civil Service Employees |

| 4 | Allah Jan Shirzad | Deputy of Bank Supervision | Deputy of Public Registration | In violation of the Regulation on Intrinsic Affairs of Civil Service Employees |

| 5 | Sulaiman Dedar | Deputy of Financial Intelligence | Deputy of Public Registration | In violation of the Regulation on Intrinsic Affairs of Civil Service Employees |

| 6 | Luftulhaq Psarli | Director of Law Implementation | Director of Financial Service Development | In violation of the Regulation on Intrinsic Affairs of Civil Service Employees |

| 7 | Khalid Wahidi | Deputy of Islamic Banking | Deputy of Financial Service Development | In violation of the Regulation on Intrinsic Affairs of Civil Service Employees |

| 8 | Obaidullah Obaidi | Manager of Information Technology | Information Technology Consultant | In violation of the Regulation on Intrinsic Affairs of Civil Service Employees |

| 9 | Bashar Mal Psarli | Director of HR | Director of Banking Institute | In violation of the Regulation on Intrinsic Affairs of Civil Service Employees |

| 10 | Aziza Dilawari | Deputy of HR | Deputy of non-Banking Institutions | in violation of the Regulation on Intrinsic Affairs of Civil Service Employees |

| 11 | Esmat Ayobi | Executive Assistant of Central Office | Deputy of Financial Stability Project | in violation of the Regulation on Intrinsic Affairs of Civil Service Employees |

| 12 | Abdul Nasir Sahak | Deputy of Public Registration | Deputy of Bank Supervision | in violation of the Regulation on Intrinsic Affairs of Civil Service Employees |

| 13 | Tamim Rafi | Director of Law Implementation | Filtration Manager | in violation of the Regulation on Intrinsic Affairs of Civil Service Employees |

| 14 | Emal Yaqini | Deputy of Public Services | – | Demotion and in violation of the Regulation on Intrinsic Affairs of Civil Service Employees |

| 15 | Zmaray Wahidi | Loan Manager | Demotion and in violation of the Regulation on Intrinsic Affairs of Civil Service Employees | In violation of the Regulation on Intrinsic Affairs of Civil Service Employees |

| 16 | Abdul Mateen Ghafoori | Deputy of Financial Services Development | Deputy of Islamic Banking | Irrelevant to Education, Demotion and in violation of Regulation on Intrinsic Affairs of Civil Service Employees |

| 17 | Abdul Rahman Behroz | Deputy Director of Procurement | – | Demotion and Removal from position (two punishment at the same time) |

| 18 | Shafiqullah Shafiq | Deputy of Banking Operations | – | Demotion and Removal from position (two punishment at the same time) |

| 19 | Jamal Nasir Raufi | Deputy Director of Law Implementation | 12 years’ work experience and Master’s in Management and Trade | Demotion and Removal from position (two punishment at the same time) |

| 20 | Mohammad Kazim Sarwari | Communication Manager of the Central Office | Transferred to Paktia | In violation of Regulation on Intrinsic Affairs of Civil Service Employees and Irrelevant to education |

| 21 | Rizwanullah Miskeen | Director of Services | Appointed to Mazar Sharif | In violation of Regulation on Intrinsic Affairs of Civil Service Employees |

| 22 | Abdul Satar | Second Manager | Transferred to Helmand | Two level demotion and transfer to Helmand |

| Awaiting With Salary | ||||

| No. | Name | Position | Work Experience in Central Bank | Current Status |

| 1 | Qahir Sahak | Deputy Director of Projects | – | Awaiting With Salary |

| 2 | Noorulhaq qani | Senior Executive Assistant to First Deputy of the Central Bank | 10 years | Awaiting With Salary |

| 3 | Ata Mohammad Andeshmand | Senior Executive Assistant to Second Deputy of the Central Bank | 15 years | Awaiting With Salary |

| 4 | Akmal Qarar | Executive Assistant to First Deputy | 2 years | Awaiting With Salary |

| 5 | Umraan | Executive Assistant to Second Deputy | 2 years | Awaiting With Salary |

These Reforms Have No Legal or Logical Basis

Members of parliament say that such changes have no logical or legal justification. Hojjatullah Kheradmand said that Ajmal Ahmadi’s presence in the bank was illegal and that any actions he took were illegal. Members of parliament have previously reacted to the issue, calling on the bank’s leadership to stop the illegal process. It should be noted that the legal process of transfer and demotion of employees is specified in Articles 21 and 23 of the Regulation on Intrinsic Affairs of Civil Service Employees and Article 19 of the Labor Law.

Legal experts, for their part, believe that such an action is illegal. On the one hand, Ajmal Ahmadi is not qualified to do so, and on the other hand, the principles of dismissal of an employee in accordance with the salaries of civil servants are not considered. Waheed Farzayee, a legal expert, said that when trying to fire an employee, the reason should be clear in the first place. He cited absenteeism and commission of crime as part of the legal reasons for thier dismissal. According to him, apart from these cases, the steps of recommendation, warning, salary deduction, demotion and transfer should be implemented and then the employee should be fired. Farzayee said that in cases such as the dismissal of the bank’s deputies, even the head of the Central Bank is not authorized to do so, and the provisions of the Da Afghanistan Bank law have been made explicit in this regard. Ajmal Ahmadi, meanwhile, dismissed one of his deputies directly without considering the provisions of the law, arguing that the Supreme Council was the bank’s highest decision-making body.

From a technical point of view, financial and banking experts also question the dismissal of the bank’s experienced employees, calling it a sign of Ajmal Ahmadi’s poor management. According to Seyar Quraishi, the dismissed individuals are experienced personnel of Afghanistan’s financial and banking sector because after the surveys, it becomes clear that there is not even 0.009% of employees who can carry out these responsibilities professionally in the country. He added that the dismissal of these employees has dealt a major blow to the Central Bank and the country’s financial sector because the investment in these employees has grown and they have been trained in several programs by the World Bank, the International Monetary Fund and other institutions.

Although the Central Bank did not provide information on the high cost of building the capacity of the laid-off staff, according to former bank officials, millions of dollars have been spent by reputable international agencies since the fall of the Taliban government because each employee’s trip has cost thousands of dollars in capacity building programs.

Illegal Recruitment and Ajmal Ahmadi Taking Sides

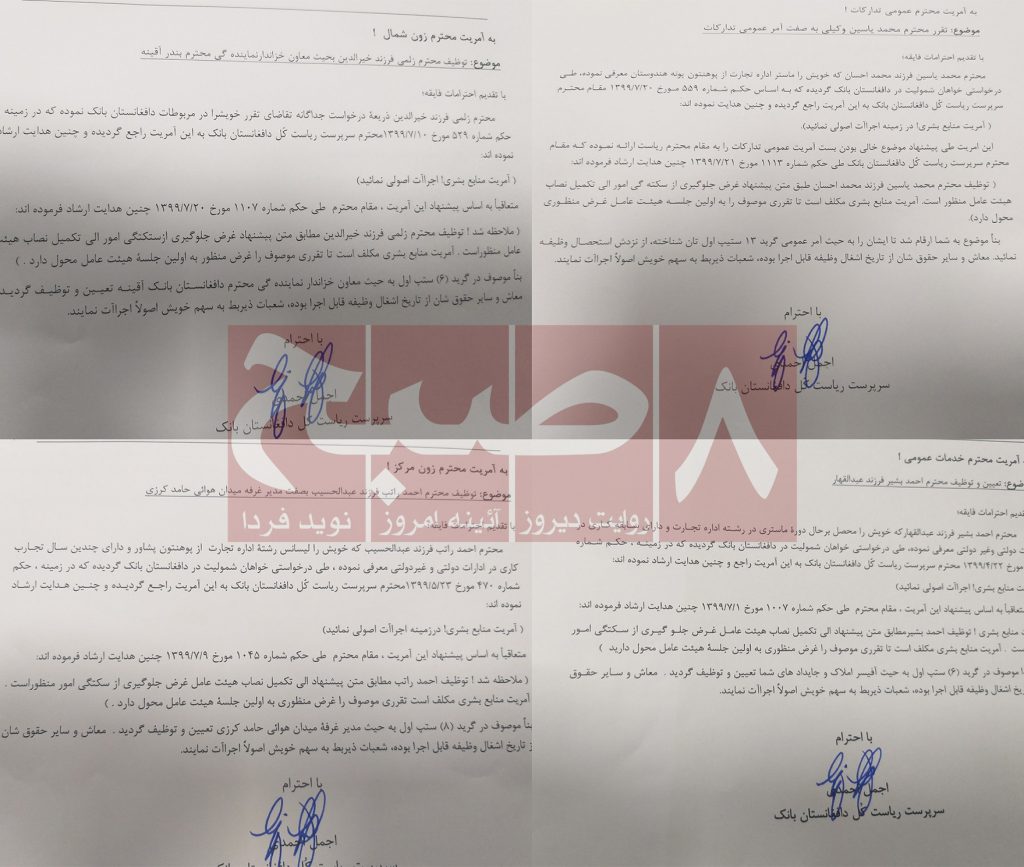

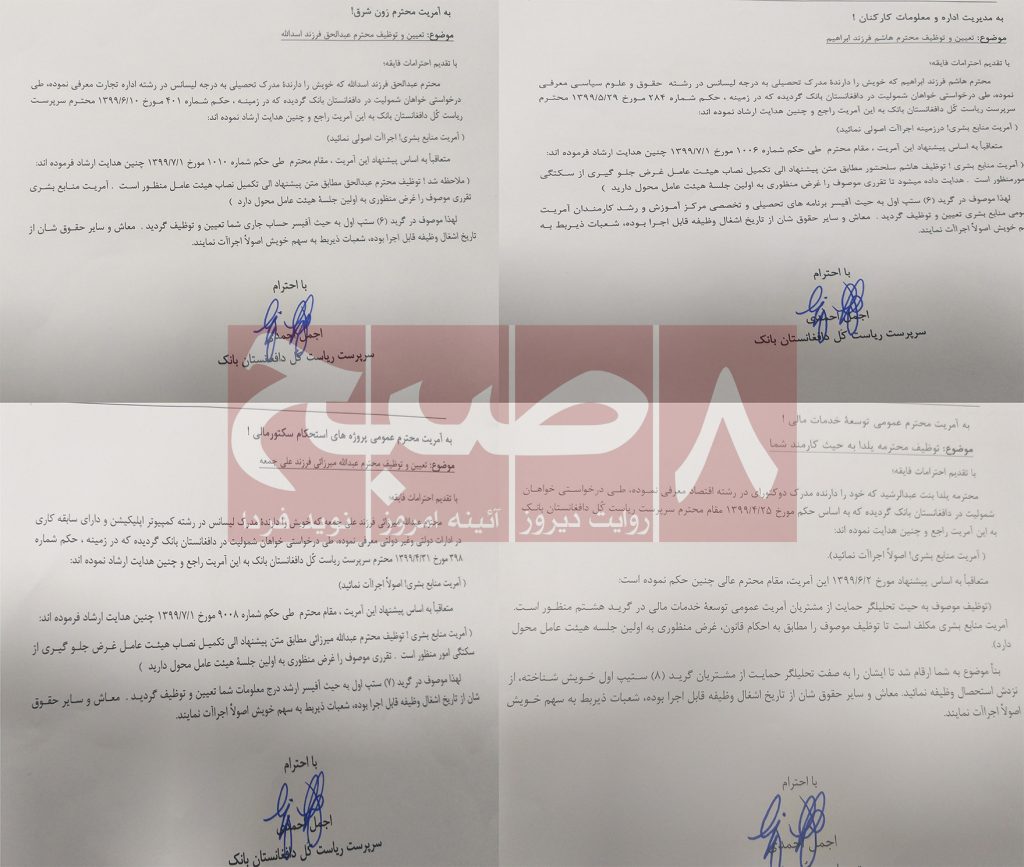

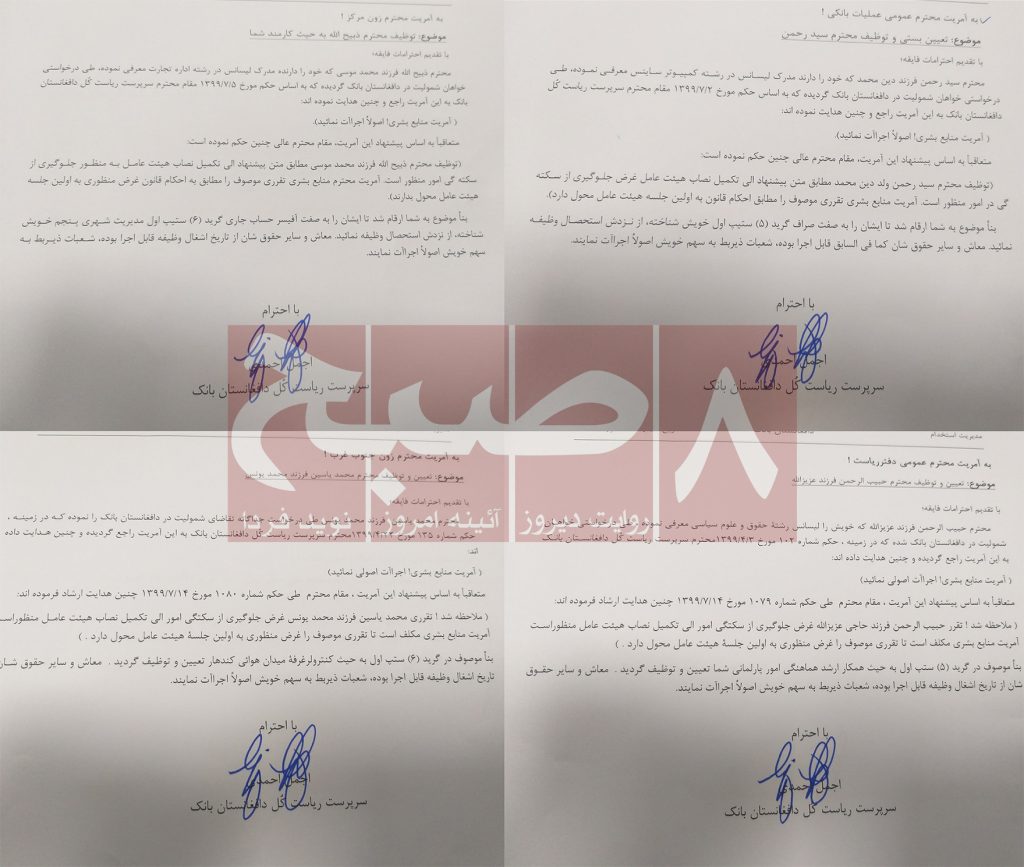

Documents, however, show that Ajmal Ahmadi has continued to replace the former Central Bank old and experienced employees with some of his former employees, both illegally and deliberately. According to the documents, most of the recruits are former employees of the Ministry of Industry and Trade and senior presidential advisers in finance and banking, and are former members of Ahmadi’s team.

According to the relevant laws and regulations of Afghanistan Bank, an employee is hired after a needs assessment, approval of the Supreme Council for the announced positions, preparation of a list of eligible individuals, passing the writing test, setting up an interview committee and finally being accepted. Also, in the first paragraph of Article 23 of the Law of Afghanistan Bank, it is mentioned that the Board of Directors, in accordance with the relevant legislative documents, appoints and dismisses the employees and representatives of this bank. Recruitments, especially Grades VI and above, must be approved by the board, with a three-vote majority without the signature of the bank chairman.

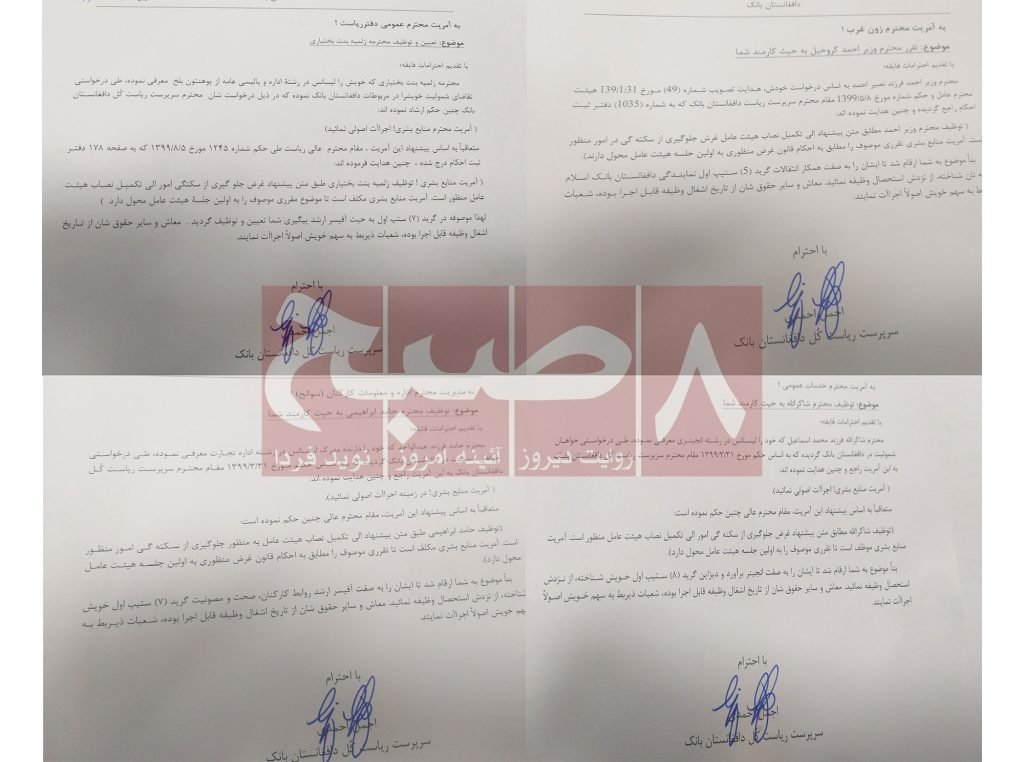

In the time of Ajmal Ahmadi, however, the recruitment was such that he satisfied in appointing with the request of an employee or with his order. For example, one of the letters reads: August 13, 2020, the esteemed official of the acting governer of Da Afghanistan Bank has referred to this directorate as follows: “Human Resources Directorate! Perform principled actions.”

The following letter reads: “Well Receievd! The appointment of Noorullah, the son of Mohammadullah, in the proposed position until the completion of the instructions of the executive board is approved. The Human Resources Department is obliged to assign the said appointment to the first meeting of the executive board.”

In this way, the applicant is directly appointed and passes the competition without any competition, without going through the legal recruitment process, including registration, shortlisting, writing exam, interview, review of educational documents and review of work experience documents. This recruitment took place in August 13 last year and its continuation is also subject to the decision of the executive board.

However, the bank has not had a board of directors since Ajmal Ahmadi took office, and no board meeting has been held because Ajmal Ahmadi has removed the two deputies of the bank from their positions in different ways. It is still unclear when the bank’s board of directors will be completed and its affairs will begin. In addition, the High Council of the Bank is incomplete and out of seven members, only five are present. Meanwhile, two council members also live abroad and are less likely to attend meetings. In the last 13 months, these people have not attended the council meetings even once.

Familial Appointments

In addition to this, some appointees are from family and relatives. For instance, two brothers, who are colleagues and close friends of Ajmal Ahmadi, are employed in different seats of the bank with a short time difference. In one case, Mohammad Momin Wakili, the son of Mohammad Ehsan, who introduced himself as “a holder of two master’s degrees in administration, trade and international trade and with seven years of experience in government and non-government offices,” applied to join the bank and on August 13, 2020, Ajmal Ahmadi has signed the order to hire him as an executive assistant to the central official of the bank (Decree No. 418).

It took only two months for the second brother to be hired in a prestigious position in the bank. On October 11, 2020, according to Decree No. 559, this time Mohammad Yasin Wakili, son of Mohammad Ehsan, “who introduced himself as the Master of Commerce from the University of Puneh in India”, applied for membership in the bank and was hired as the Director of Central Bank Procurement.

Employment without free competition (from the Ministry of Industry and Trade and Presidential Economic and Banking Advisory).

| Appointments Without Free Competition (From Ministry of Industry and Trade and the Economic and Banking Advisory of the Presidency) | ||||

| No. | Name | Position in Central Bank | Experience at Time of Appointment | Exclamations |

| 1 | Yar Mohammad Rustam | Manager of Financial Stability project and now, general director of the central office of the bank | None | Ministry of Trade |

| 2 | Shabnam Amini | general director of the central office of the bank and later, director of international relations | None | Ministry of Trade – Has now resigned |

| 3 | Yasin Wakili | Director of procurement | None | Momin Wakili’s brother |

| 4 | Momin Wakili | Special Assistant to Central Office | None | Ministry of Trade – Yasin Wakili’s brother |

| 5 | Sayed Umraan | Senior Coordinator of the Central Office | None | Presidential Palace – has now resigned |

| 6 | Shah Maqsood Babak | Director of information technology | None | Ministry of Trade |

| 7 | Noorullah Mayar | First as Deputy Director of Internal Supervision / currently Deputy Director General of Banking Operations | None | Ministry of Trade – Essa Mayar’s brother |

| 8 | Essa Mayar | General Directorate of Zone Coordination | None | Ministry of Trade – Noorullah Mayar’s brother – position was created for him |

| 9 | Faryal Yaqubi | Translator | None | Ministry of Trade |

| 10 | Wajiha Temori | Deputy and Head of Legal Advice | None | Deputy position was created for him |

| 11 | Fatima Nabizada | First Deputy Director of Non-Banking Supervision / then General Director of Human Resources | None | Presidential Palace |

| 12 | Abdul Karim Malikyar | First Advisor to the President / then Director of International Relations | None | Caretaker of the deputy of Industry Ministry – position was created for him |

| 13 | Ahmadullah Anas | Deputy Chief of Staff (died in an explosion with Yama Siavash) | None | Position was created for him |

| 14 | Hussain Alimi | General Manager of the Financial Strength Project | None | – |

| 15 | Zabiullah Akbari | General Directorate of Bank Liquidation | – | Presidential Palace– position was created for him |

| 16 | Rasool Yosufi | First the Director General of International Relations / then the Deputy Director General of International Relations | None | Ministry of Trade – position was created for him |

| 17 | Geeti Sadaat | Deputy Director of Public Administration Education | None | – |

| 18 | Saeeda | Secretary of the Central Office | None | Now: Undergraduate Student |

| 19 | Ahmad Shakir Wali | Head of Afghanistan Payment System | None | Afghanistan Holding Group – Close friends of Sanzar Kakar who is friends with Ajmal Kakar |

| 20 | Ali Reza | Manager of Public Awareness | None | – |

| 21 | Khalid Ali Mohammadi | Legal Director | None | Ministry of Trade – has now resigned |

| 22 | Esmatullah Kohsari | Spokesperson and Media Manager | None | – |

| 23 | Abdul Zakir | Security Camera’s Manager | None | Ministry of Industry and Trade |

| 24 | Mahboba | Central Office Translator | None | Friend and Classmate of Yar Mohamamd |

It should be noted that most of these recruitments took place before Ahmadi went to the parliament to get a vote. Meanwhile, Rahmatullah Nabil, the former head of national security, had introduced the candidates for the post of central bank acting governer to the parliament on December 1, 2019, saying that Ajmal Ahmadi had paid members of parliament in the House of Representatives to vote for him. However, Ajmal Ahmadi and the Central Bank at the time did not even take a stand on this serious charge. In addition, pictures of him and United Bank owner Jawid Jaihoon were released as Jaihoon tried to slap him on the shoulders. Financial and banking experts consider this to be conflict of interest.

It should be noted that among these recruitments, the presence of Yar Mohammad Rustam as the Director of the Central Bank’s Head’s Office is more controversial. This is because, according to former bank employees, this person adapts the content of official documents to Ajmal Ahmadi’s satisfaction. Some former employees of the bank say that Yar Mohammad Rustam, due to the authority he has obtained, has laid the groundwork for the dismissal and transfer of these employees following the non-fulfillment of the demands of Ajmal Ahmadi team.

For example, the former deputy director of logistics at the Central Bank says that Yar Mohammad Rustam had asked him to provide information to the Attorney General’s Office regarding the cases of some former employees of the bank, which is against these employees and in favor of Ajmal Ahmadi’s team. It is worth mentioning that sources mention Yar Mohammad Rustam, a close associate of Mr. Ahmadi, as Ahmadi’s preferred candidate for the post of Deputy of the Bank, and consider the realization of this as the beginning of a serious leadership crisis in the Central Bank and the financial sector.

Gaps in the Reforms; Outsiders Use The Bank’s Vehicles

These changes, however, are not the end of the story at the central bank. At the end of June this year, when Ajmal Ahmadi went to Dubai for his wedding, he appointed another person as the Acting governer. Abdul Wahed Jabarkhil, General Manager of Banking Afghanistan on June 15 this year, took over the governorship in a situation where the bank did not have a board of directors and a deputy, and by law, responsibility should be vested in high-ranking individuals. Thus, Ahmadi selected a low-level employee as the bank’s auditor for a period of time.

Earlier, during the bank’s changes, Ahmadi also transformed the bank’s security team. The transfer came after Abdul Ghafar Dawi, a former shareholder in Kabul Bank, came to the bank on July 27 and met with Ajmal Ahmadi. Central Bank officials at the time stated that this was done without coordination, but sources say that such a discrepancy is not possible due to the presence of Ajmal Ahmadi’s working team and especially his office secretary. Because in the past, the bank’s security officials did not allow people other than bank employees to enter, and that this is the procedure in the bank.

However, it was decided that the new employees would replace the old ones. Only a few months after this action, an explosion occurred on the car carrying Yama Siawash, after which three bank employees were killed. In addition to not providing any information in this regard, the Central Bank did not even provide security camera images to the families of the victims. Sources now say that in the context of the hypothesis that explosives were placed inside the Central Bank vehicle, one of the reasons for the incident could be the creation of a security vacuum due to a change in the security team because former security staff were familiar with the bank’s approach and better segregated staff.

Also, some people close to Ajmal Ahmadi, with whom he used to work in the Ministry of Industry and Trade, use bank vehicles for their personal purposes. Meanwhile, Ajmal Ahmadi, as the acting governer of the bank, issued an order on June 6 last year not to use the bank’s facilities for personal purposes. In this way, although his order is considered enforceable in the bank, but people close to him who are employees of other institutions and have nothing to do with the bank, in some cases have used the bank’s vehicles.

Central Bank in a Serious Test; Descend Instead of Ascend

Although the fiscal year 2020 was also associated with the outbreak of the coronavirus, the evidence shows that in addition to crises, the management of the central bank’s monetary policy has not been ineffective in the outcome of the bank’s work. According to the usual approach, the central bank typically buys government and international donor funds deposited in the bank’s account at the bank in Afghan currency at the current exchange rate. The Central Bank then sells some of the purchased currency to control the amount of Afghan liquidity in the market through the bank’s monetary policy, called “Lilam-e-Arz (Money Aution)”. In fact, the difference between the purchase rate of foreign currency from the Ministry of Finance and its sale in the market shows the net profit and loss resulting from the bank’s foreign exchange transactions.

Now, the Central Bank’s audited financial statements report for the last fiscal year show that the bank has experienced a serious decline in the Afghan currency. According to statistics, the Central Bank has provided more than 21 billion Afghanis in fiscal year 2019, after 2,430,000,000 dollars. However, during Ajmal Ahmadi’s time, the bank lost more than 124 million Afghanis with $2 billion and $127 million, in addition to not including provisions. This is actually a 101 percent drop in the money auction’s foreign exchange earnings.

Although profits and losses have always existed in the currency and the value of the dollar against the Afghani has fluctuated in recent years, at least in the last 10 years, this is the first time that the bank has suffered such losses instead of benefiting from the currency. It should be noted that this case needs further investigation because the accuracy of the bank’s profit and loss should be clarified after knowing the exchange rate of the money purchased by the bank and its exact time. The value-added figure has also been impressive in recent days, and the Central Bank, led by Ajmal Ahmadi, has laundered more than $700 million in the past 35 days alone to keep the Afghan value stable. Experts in finance and banking consider this irrational ammount to be a nuisance for the difficult days of the country and dangerous for the performance of the country’s monetary and exchange rate policy in the future.

In total, the Central Bank has earned only 3 billion 781 million 139 thousand Afghanis during the fiscal year 2020. This statistic reached 29 billion 230 million 712 thousand Afghanis in the fiscal year of 2019. Thus, the bank’s total assets have been reduced by about eight times. In addition, the bank’s comprehensive income has decreased from 46 billion 508 million 722 thousand Afghanis in the fiscal year 2019 to 24 billion 934 million 419 afghanis in the fiscal year 2020.

Similarly, the Central Bank’s net cash flows from operating activities have decreased from 209 billion 649 million 207 thousand Afghanis in fiscal year 2019 to 80 billion 177 million 921 thousand afghanis in fiscal year 2020. In addition, net cash flows from investment activities increased from negative 9 billion 138 million 207 thousand Afghanis to negative 149 billion 824 million 842 thousand Afghanis, which is due to the investment of the Central Bank in the past year in They know places that have very low returns. Meanwhile, the House of Representatives says that at present, and considering the presence of Ajmal Ahmadi, he does not expect any benefit from the bank.

Financial and banking experts also believe that the reduction in central bank revenues requires research. Seyar Quraishi told 8 Subh that at the same time as the reduction, bank officials announced a $500 million increase in the bank’s foreign exchange reserves. According to him, the Central Bank needs to explain how, in addition to the billion-dollar decrease in bank revenues due to the coronavirus, $500 million in foreign exchange reserves have increased. He said that if the reason for the work is the global increase in the price of gold, then this achievement is not the work of Ajmal Ahmadi. Quraishi described the drop in revenue as a sign of Ahmadi’s unhealthy administration and leadership, which harms the Central Bank as the backbone of monetary policy regulation and banking supervision.

The Increase in Foreign Exchange Reserves in the Agencies Coincided with the Expansion of the War

In addition, the Central Bank report shows that the bank’s stagnant reserves have increased. According to the financial statements of 2020, the stagnant currency in the bank’s reserves has increased from 19 billion 583 million 336 thousand Afghanis to 34 billion 167 million 341 thousand Afghanis. This statistic actually indicates a 75% increase in stagnant foreign exchange reserves of the Central Bank. However, in the case of investment, the potential single income is obtained from this perspective, and with the increase of stagnant money, the central bank’s provisions decrease accordingly.

In addition, the amount of foreign exchange reserves in the Central Bank representative offices has increased during the fiscal year 2020. The report on the financial statements of 2020 states that the foreign exchange reserves of the bank’s offices have increased from 1 billion 12 million 425 thousand Afghanis in the fiscal year 2019 to 15 billion 596 million 430 thousand Afghanis in the fiscal year 2020. Thus, the foreign exchange reserves of the Central Bank in the provincial offices have increased about 15 times. However, the sources of this currency have not been identified in the bank’s offices.

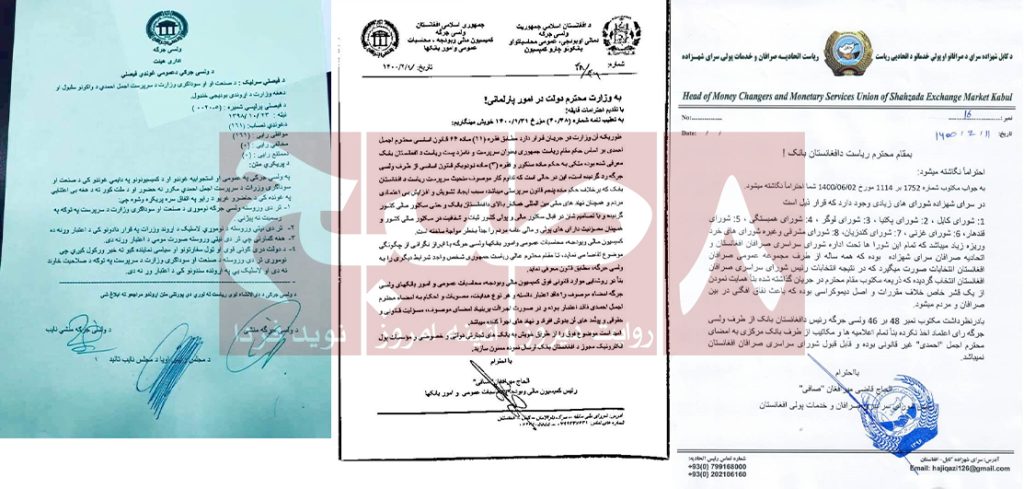

This action is being taken at a time when the scope of the war is widening with each passing day, and there is even a danger of the provinces falling and the loss of these reserves. Members of the House of Representatives say that Ajmal Ahmadi is not aware of the situation in the country and that his decisions endanger the national monetary reserves. Abdul Zahir Salangi, a member of the House Finance and Budget Committee, told 8 Subh that the country was in a state of emergency and that such ill-considered decisions were setting the stage for Afghanistan’s devastation. Some other members of parliament are even skeptical of the move, calling it part of deliberate and organized work.

Why is The Increase in Foreign Exchange Reserves in The Agencies Worrying?

The experience of former members of the Central Bank in the fall of the provinces shows that the unprecedented increase in foreign exchange reserves in the provinces is worrying. Kunduz is one of the provinces that has experienced several Taliban attacks and falls. In 2015 and 2016, the province came under the control of the Taliban twice, but was recaptured by security forces. During this time, the reserves of some private banks were looted.

Shafiqullah Shafaq was in charge of the Central Bank in the Northeast for seven years, governing Takhar, Badakhshan, Kunduz and Baghlan provinces. He, who was present in two consecutive falls of Kunduz in that province, was able to save the equivalent of seven million dollars in the first fall and the equivalent of five million dollars of the Central Bank in the second fall by transferring money to other banks. Shafaq delivered the money to Kunduz airport while the Taliban were in the suburbs, and from there to Mazar-e-Sharif by military aircraft.

Although local officials did not cooperate and even asked him to distribute the money under the pretext of falling, Shafaq, in coordination with some institutions, kept the Central Bank’s foreign exchange reserves in Kunduz safe despite all threats. His opposition to some of the circles prompted Shafaq to call for his transfer to Kabul due to security threats against him. Despite opposition from Central Bank officials, he was eventually accepted because of his knowledge of the Northeast, and Shafiqullah Shafaq came to Kabul as his deputy for banking operations.

Ajmal Ahmadi, however, as soon as he was present at the bank, with the help of a close friend and colleague named Yar Mohammad Rustam, Shafaq was transferred to the Operational Banking Institute with a reduced salary due to personal animosity of Ajmal Ahmadi. After a month and a half, he terminated Shafaq’s team, which included 22 employees in three departments of human resources, IT and finance. In this way, the main employees of this institution, who were familiar with the work system, were demoted and some other employees were transferred as support staff. The former Central Bank official clarified that due to the unprecedented increase in the bank’s reserves in the agency and especially the current unfavorable conditions, it is not possible for the bank’s reserves to be safe.

Financial and banking experts also say that the increase in the foreign exchange reserves of the agencies requires more clarity. Seyar Quraishi, the former chief executive of Ghazanfar Bank and the former chairperson of the Union of Banks, added that there are two issues in discussing the foreign exchange reserves of the central bank’s offices. According to him, the Central Bank’s operating procedure states how much money will be kept in which representative office and the rest will be transferred to the Central Bank’s office in Kabul. But he considered this part to be normal.

Quraishi, however, said that in case of emergency, the bank’s regulation states that even if one Afghani of treasury money is in the representation, it should be transferred to the center immediately, and in this case, the previous procedure is not applicable. He added that in such a situation, it is important that the Central Bank leadership, deputies and managers, in coordination, transfer millions of dollars to the center as soon as possible because in emergency situations, no procedure is considered.

According to Quraishi, in a situation where most provinces are insecure and there is a possibility of misuse of these funds, the proposed international solution from the point of view of operational risks stipulates that cash should be kept at a very low level because if something happens, at least cash is safe. He attributed this directly to the understanding and knowledge of the bank’s leadership, and said that bank officials should be held accountable for raising cash so much in such circumstances.

The Bank’s Annual Income Has Decreased by 45%

One way to earn revenue at the Central Bank is to make a profit. In terms of income, ‘Tikitana’ refers to income earned in return for borrowing money. But in terms of costs, Tikitana refers to the costs that are paid in return for the use of the loan. According to the report on the liquidation of financial accounts in 2019, the Central Bank’s monetary income reaches 9.5 billion Afghanis. However, in the fiscal year 2020, this revenue decreased by 45% to 5.3 billion Afghanis. This is while the amount of investment has increased by about 40% compared to last year. Banking experts say the reason for the 4.2 billion decreases in single revenues is the risk-taking of former officials and their ability to manage risk. According to these sources, at that time, the Central Bank considered risk and return in its investment plan. In this way, part of the reserves was invested in areas that had high returns, and this caused a small increase in revenues for the Central Bank in this area.

However, according to these sources, the Central Bank has already shifted a large part of its investment to areas with very low returns, and as a result, the bank’s monopoly profit and revenues are reduced. Experts point out that most of the Central Bank’s investment is in US Treasury bonds, which it pays very little, given other opportunities in international markets. They call the move undesirable and point out that it has reduced the Central Bank’s monetary revenue. Meanwhile, the amount of investment has increased from 26.218 billion Afghanis in fiscal year 2019 to 368.8 billion afghanis in fiscal year 2020.

Increase in Single Rate on Overnight Deposits and Central Bank Securities

In part, the Central Bank has increased its monetary policy on overnight deposits and Central Bank securities. Overnight deposits and securities are monetary policy instruments used by the Central Bank to reduce and control monetary inflation through money supply management. In inflationary situations, the Central Bank uses the ease of overnight deposits (taking the bank’s surplus cash overnight) to absorb the bank’s excess liquidity, thus preventing it from being used by banks for lending. It should be noted that the use of this monetary policy tool is effective when monetary inflation is effective when banks have the potential and strong lending capacity.

Capital bonds are also considered as another instrument of monetary policy, in which the Central Bank sells them to the banks, absorbing their excess liquidity and thus controlling the rate of monetary inflation. It should be noted that this monetary policy tool is effective in controlling monetary inflation when banks can lend their excess liquidity to the private sector. The Central Bank sells securities with a maturity of one week, one month, three months, six months and one year above the banks and reduces their liquidity in the short, medium, and long term. When banks face liquidity problems, they can resell their purchased bonds again at a discount to the Central Bank.

Since the country’s banking sector has averaged 85% in cash over the past few years and has been able to lend only 15% of its facilities on average, the Central Bank has set very little overnight deposits and securities, and sometimes even the ease of overnight deposits stopped altogether. This was because the banks’ money was stagnant and kept in their surplus reserves, thus having no inflationary effect. In addition, commercial banks are not interested in lending to the private sector if the Central Bank pays a large amount of capital securities, and without playing a role in the country’s economic growth through this, with peace of mind and without accepting any kind. They invest in Central Bank securities.

Meanwhile, during the Ajmal Ahmadi era, the Central Bank increased the high single rate of overnight deposits from 0.1% per year, in January 2021 to 0.5%. Then, at the end of the year 2020, it rose to 3% per year, and on July 4, 2021 to 6%. Although Ajmal Ahmadi initially insisted on raising the high one-time deposit rate to 10 percent a year, he was strongly opposed by monetary policy directors and bank supervisors, which even led to the forced resignation of the monetary policy chief. The resignation of the head of the said department continued afterwards. At the same time, the high single-year rate of one-year securities has gradually risen to 6.5 percent a year.

According to financial and banking experts, due to the unprecedented increase in the debts of the country’s commercial banks, which reached about 22% at the end of fiscal year 2020, the Central Bank is trying to compensate the losses of the banking sector by paying a large installment from the treasury. The Central Bank has previously officially announced that it expects an increase in troubled loans to commercial banks in the coming months.

Banking experts call such a decision inappropriate and unreasonable because they believe there is no effective way to control monetary inflation. These insiders point out that this greatly destroys the incentive for banks to lend to the private sector and, most importantly, reinforces speculation about systematic and complex corruption in the minds of insiders. They state that such decisions require technical investigation by the foreign professional faction. According to experts, the signing of bank lending agreements with the private sector at the same time as the payment of high installments, shows a serious contradiction.

Bank’s Efforts to Support a Special Payment Institution

As the central bank of the country, Da Afghanistan Bank plays a key role in creating, growing and strengthening the country’s financial systems. Experts in finance and banking call one of the most important actions of the Central Bank over the past 10 years the creation and growth of electronic payment systems. For this reason, the Central Bank, through the Afghanistan Payment System Administration, created a national payment card scheme called “AFP” to use this card through banking and non-banking institutions for customers of financial institutions to conduct various financial transactions, including purchases, money transfers and issue a license electronically.

Thus, the Central Bank, in supporting all banking and non-banking institutions equally and without any discrimination and bias, is obliged to provide the ground for the issuance and growth of the use of national payment card services for all banking and non-banking institutions. Evidence, however, shows that the officials of the relevant departments of the Central Bank have used the name of a special electronic payment services company, Pay Account, which is a subsidiary of the Afghanistan Holding Group, in the official forms of issuing the national payment card “AFP” for its employees.

Private companies consider this to be against the rules and principles of the Central Bank. Meanwhile, in Afghanistan’s financial sector, about 10 domestic banks, two foreign banks, four payment institutions and four electronic money institutions are officially operating and licensed by the Central Bank. Financial and economic experts call this action the cause of financial and moral losses for the electronic payment services sector and believe that this will cause the loss of the status and achievements of the past.

The move comes as Ahmad Shakir Wali, head of Afghanistan’s Payment System and an employee of the Afghanistan Holding Group, was appointed by Ajmal Ahmadi to a key position at the Central Bank, which insiders believe is a sign of “Account P” has raised concerns about the Central Bank’s neutrality.

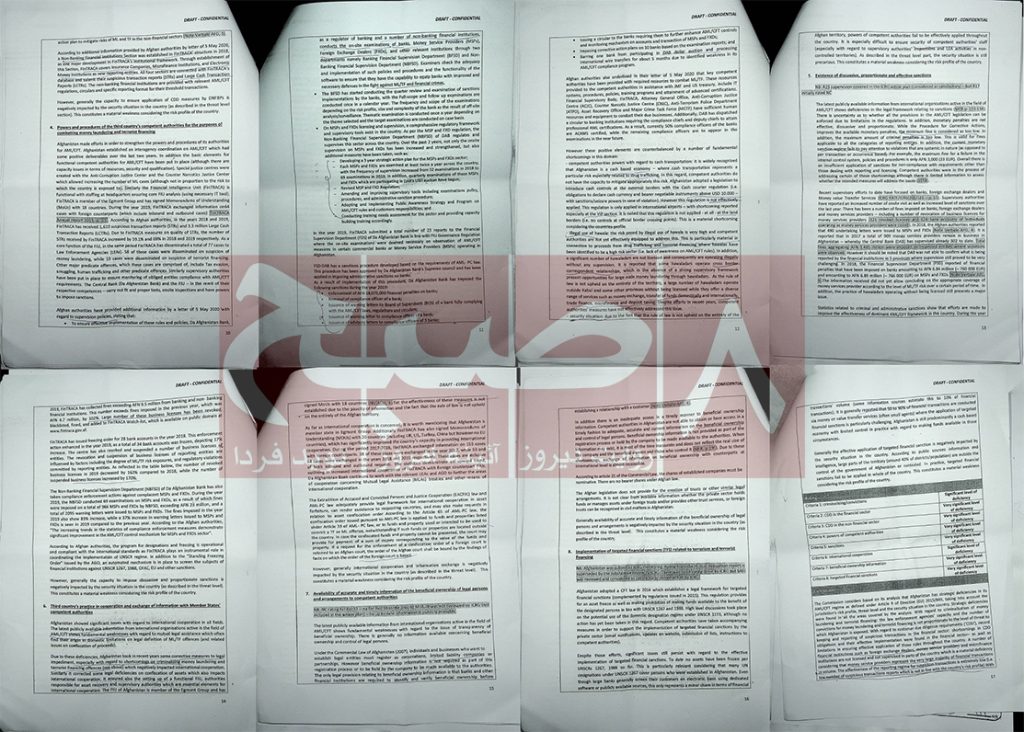

International Warnings at The Same Time as The acting governer of the Bank Tries to Sign the Banknotes

Banknotes worth 100 billion Afghanis are scheduled to be printed soon. These banknotes are 500 and one thousand Afghani notes, and their procurement work has been completed by the National Procurement Office and the Central Bank. Sources at the presidential palace now say that Ajmal Ahmadi, despite his position as caretaker, is trying to sign the banknotes. According to sources, most government officials have opposed the issue, but Ajmal Ahmadi is trying to persuade the president.

However, according to the second paragraph of Article 36 of the Da Afghanistan Bank Law, banknotes must only contain the signature of the Minister of Finance and the Chair of the Da Afghanistan Bank. This article states: “The face value, size, shape, material, content, weight, design and other specifications of banknotes and coins shall be specified by Da Afghanistan Bank in the relevant regulations. The banknotes are signed by the Minister of Finance and the Chair of Da Afghanistan Bank.” In this way, only the Chair of the Central Bank – not the caretaker – can sign the banknotes from the bank’s address. It should be noted that this had already provoked a serious reaction from the House of Representatives because, according to members of parliament and experts, this is against the law and will negatively affect the legitimacy of the Afghan currency in the future.

At the same time, the exchanged letters and talks indicate that Afghanistan, if such conditions continue, will be blacklisted by the International Monetary Fund. The letter from the European Union to the Foreign Ministry and the Central Bank noted that Afghanistan was lagging behind in meeting international demands for money laundering and counter-terrorism funding. It should be noted that Ajmal Ahmadi’s personal e-mail has been used on every important and confidential letter. According to the principles, all former Heads of Central Bank had official emails for communications and business conversations, and according to it, future bank chairs could be informed of information that has happened in the past by referring to the archive of the bank’s emails.

Sometimes finance and banking also state that this risk arises from the relocation and dismissal of professionals in the bank. Seyar Quraishi said that Afghanistan is scheduled to pass an assessment in 2022. According to him, the Financial Action Task Force and the Asian Pacific Group, as subdivisions, are carrying out this assessment and it is possible that Afghanistan will return to the gray list of the World Monetary Fund because the Central Bank currently has many problems and professionals are not present, especially in the financial intelligence of the Central Bank. It is worth mentioning that financial intelligence is a part of the bank that operated independently in the past years, but then its chairperson and some of its employees were fired by Ajmal Ahmadi in violation of the laws and regulations in force in this sector.

Deceiving the People

The vague actions of the Central Bank have no end. The bank announced on July 3, 2021 that a female employee of the agency had been fired for not including the Pashto language in the document fulfilling the commitments of the Geneva Meeting. The bank’s officials at the time vaguely addressed the issue and did not specify who had been fired. At that time, only one bank employee named Wajiha Timori, who is the Deputy of Legal Department of Da Afghanistan Bank, had signed the same letter and his identity was determined. According to the information, Timori is one of the people close to Ajmal Ahmadi, who was hired by Mr. Ahmadi last year by creating a position for her and without free competition, and is considered a key member of his working team.

However, sources at the Central Bank say no one has been fired for this reason. Wajiha Timori, who signed the letter below, also continued to work at the bank last week and this week. In this way, the officials of the Central Bank, by publishing a video and sponsoring it on social media, have shared false information with the citizens. According to the working principles of the institutions, after the dismissal of the employee, it is necessary to send letters about the severance pay, dismissal from attendance sheet, non-provision of transport services and the separate entry of the employee in the accident office.

In addition, Ajmal Ahmadi published an article in the Bakhtar Intelligence Agency on May 31 this year, saying that during his tenure at the Central Bank, he had made 70 regulations. Sources at the Central Bank now say that no new regulations were made by Ajmal Ahmadi, but that he has compiled the previous regulations and called it the “Book of Regulations”.

The Central Bank is the Most Closed-off Institution in Terms of Access to Information

According to the Right to Information Commission, the Central Bank, headed by Ajmal Ahmadi, has become the most closed-off institution in terms of access to information. Ainuddin Bahadory, head of the Information Access Commission, said that in the past, former central bank officials had close ties to the commission and the media, sharing information on a regular basis, but that the process is now deadlocked. Thus, the Central Bank is the only institution that does not cooperate with the Commission on Access to Information. According to Bahadory, the Central Bank is not accountable for the reasons it has, and the information gate is closed to the media and information seekers. The head of the Access to Information Commission stated that she would raise this concern with relevant institutions, including the High Council of Rule of Law, the Office of the President and some other institutions.

However, despite the passage of a month and the receipt of a complaint form by 8 Subh from the address of the Information Access Commission, the Central Bank officials refused to provide the information. The officials of this institution did not even take a stand against the allegations and documents that were presented.

Although the discussion of Ajmal Ahmadi breaking the law was published in the Ministry of Industry and Trade and then the Central Bank, the Presidential Palace did not react seriously in these cases. Some members of parliament and insiders believe that he is still close with the president, despite the poor and illegal performance as the acting governer of the Central Bank because the Presidential Palace is trying to expand its sovereignty over independent institutions.